Review February 2022

- Posted By David Brown

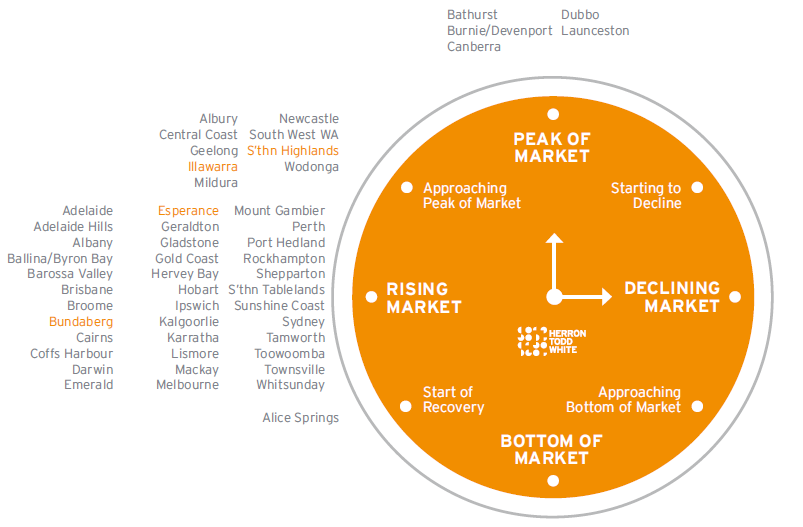

HTW (Herron Todd White) are one of Australia’s leading property valuers. Their monthly market update and Property Clock provides a good insight into where property markets are at and where they are heading.

If HTW have a view on markets, we take note. Why? Because they are the people doing the finance valuations that determine if people get finance or not. It is good to know what they are thinking about where markets are heading and their level of confidence.

Here is the latest property clock and the Meridien view on what is happening in Australian property markets. For property market watchers, have you ever seen the property clock void of markets in decline or at the bottom of the market? Interesting times indeed and understanding the micro-market opportunities will be a key factor for investors as we move into 2022.

Some Key Trends to Watch in 2022

NSW Regional markets out-performing Sydney

Affordability driving demand in SW Sydney

Central Coast and Hunter demand increasing and prices rising

VIC CBD apartment market crushed by fall in demand from overseas students

Regional markets best performers

QLD Brisbane best performing capital city market

Regions performing well

Demand in overall SEQ market increased in under-supplied market

WA Perth market rebound

We think Perth houses market is one to watch

Brisbane

In 2021, Brisbane was the place everyone wanted to be. The market saw the strongest increase in property value growth in the country, increasing 26.1%.

So where will the Brisbane Property market go in 2022? Well, it is expected that Brisbane will once again outperform the rest of the country, with some experts predicting the market will increase anywhere for 8% to 25% in the coming year.

The Queensland Government has already got major infrastructure projects in the pipeline to support the recent interstate migration and the upcoming 2032 Olympics.

With the rental market in the region getting tighter and tighter it is becoming more favourable for interstate migrates and locals to purchase property. The low vacancy rates and high rent prices are expected to continue in 2022.

Brisbane will certainly be the market to watch in 2022, even considering factors of the federal election, the potential increase of interest rates, and the rising costs of construction. Brisbane is still expected to perform well just maybe not at the astounding rate that was seen in 2021.

Meridien have seen the same patterns across SE Queensland and expect that the overall SEQ market will mirror Brisbane’s performance. Freestanding homes are the bright star in the market and as affordability becomes an issue, there will be flow-down demand into the townhouse market which is worthy of watching as we move into 2022.

Perth

It is already clear that Perth’s property is going to follow the same trends it saw in 2021.

Western Australia saw record low vacancy rates and stock levels throughout 2021. In 2022, it doesn’t look like the market is going to slow with prices being driven upwards by investors and homeowners who are finding purchasing is cheaper than renting.

It is expected that with the eventual opening of Western Australian boarder the influx of new and returning residents will increase prices and squeeze supply even more. The supply will be decreased even more so with the substantial delays on building. Back in 2020 a build was averaging 26 weeks, this coming year builds are expected to take up to 2 years to complete.

It still looks like 2022 will be a strong year for Western Australia. Although it will largely depend on migration rates, it does look like there will be a high demand while supply remains slim, this will be the case particularly in the first half of the year.